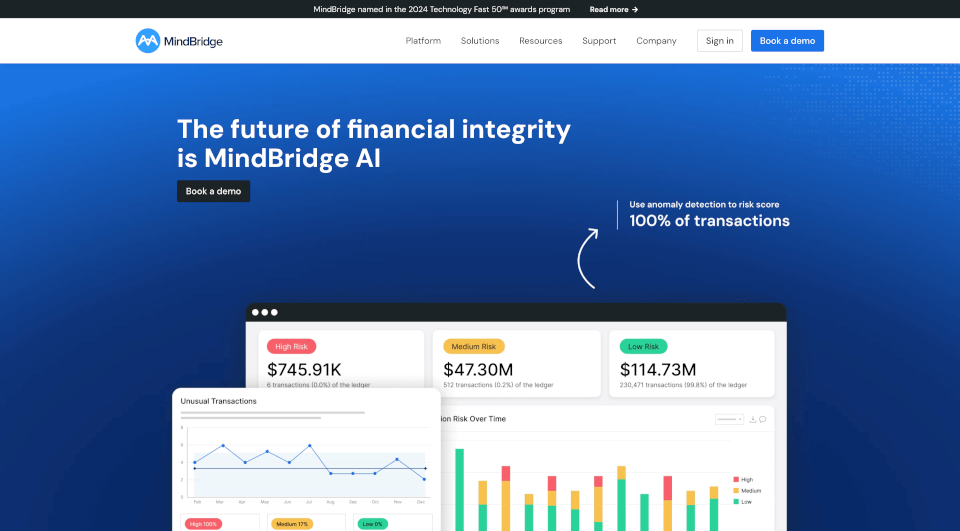

What is MindBridge AI?

MindBridge is a global leader in financial risk discovery and anomaly detection, empowering financial professionals to efficiently identify, analyze, and assess risk across extensive financial datasets. With the MindBridge AI™ Platform, organizations can gain continuous oversight on their financial transactions, enhancing their operational integrity and risk management.

What are the features of MindBridge AI?

General Ledger Analysis

The General Ledger Analysis tool is designed to identify anomalies and unusual patterns, focusing on areas that require immediate attention. This feature helps organizations maintain a holistic view of their financial statements.

Customer Analysis

MindBridge’s Customer Analysis provides critical insights into revenue recognition risks, revenue segmentation, and unexpected activities, ensuring accurate financial reporting and revenue management.

Payroll Analysis

With Payroll Analysis, companies can reduce potential financial losses associated with inaccuracies or fraudulent payroll allocation. This tool meticulously evaluates payroll data to ensure compliance and accuracy.

Travel & Expense Analysis

The Travel & Expense Analysis feature aids in uncovering anomalies, spotting trends, and safeguarding company card transactions. Organizations can control expenditure more effectively and minimize fraud risk.

Vendor Analysis

Vendor Analysis reduces financial loss associated with incomplete, inaccurate, or untimely invoices. This feature allows for better management of supplier relationships and expense tracking, ultimately safeguarding the bottom line.

Real-time Continuous Monitoring

MindBridge provides the capability for real-time continuous monitoring across all financial data, allowing companies to catch errors before they escalate, significantly saving costs and maintaining financial health.

Pre-built Machine Learning Algorithms

The platform comes equipped with pre-built machine learning algorithms that analyze all transactions continuously. This provides a targeted and efficient approach to identifying risks and errors that might go unnoticed in traditional audits.

Robust Automation Tools

MindBridge's powerful automation tools discover unknown risks and surface anomalies in your datasets, enabling professionals to focus on high-risk areas, thus optimizing their time and resources for maximum effectiveness.

Advanced AI Integration

With over 250 unique machine learning control points, combined with statistical methods and traditional business rules, using advanced AI integration, MindBridge stands at the forefront of financial risk discovery.

What are the characteristics of MindBridge AI?

- Comprehensive Analysis: The platform analyzes 100% of transactions, giving users a complete view of financial accuracy and uncovering hidden anomalies.

- User-friendly Interface: The intuitive user interface ensures that financial professionals can navigate the system effortlessly, making financial data accessible and understandable.

- Customizable Solutions: MindBridge provides adaptable solutions that can be tailored based on specific organizational needs and existing systems, enhancing user experience.

- Global Reach: Deployed to over 27,000 accounting, finance, and audit professionals globally, MindBridge has a proven track record in enhancing financial integrity.

What are the use cases of MindBridge AI?

- Audit and Assurance: MindBridge is essential for audit professionals looking to supercharge their audit techniques with reliable anomaly detection.

- Financial Reporting: Organizations looking to improve the accuracy of their financial reports can leverage MindBridge’s capabilities to ensure clean and precise data.

- Risk Management: Ideal for companies wanting to establish a robust risk management framework to continuously monitor transaction integrity and reduce potential losses.

- Fraud Detection: Utilize MindBridge for proactive fraud detection across payroll, travel, and vendor transactions, safeguarding financial assets.

- Digital Transformation: Companies aiming to undergo digital transformation can integrate MindBridge into their operations for improved financial insight and operational efficiency.

How to use MindBridge AI?

- Sign Up for a Demo: Interested users should start by booking a demo to understand MindBridge’s offering comprehensively.

- Platform Configuration: Upon adoption, configure the platform based on your existing systems and requirements for a tailored solution.

- Input Financial Data: Integrate your financial data sets into the platform for immediate analysis and anomaly detection.

- Monitor: Utilize the continuous monitoring feature to keep an ongoing check on financial transactions.

- Analyze Results: Regularly review the findings from the automated analyses to identify and mitigate risks proactively.