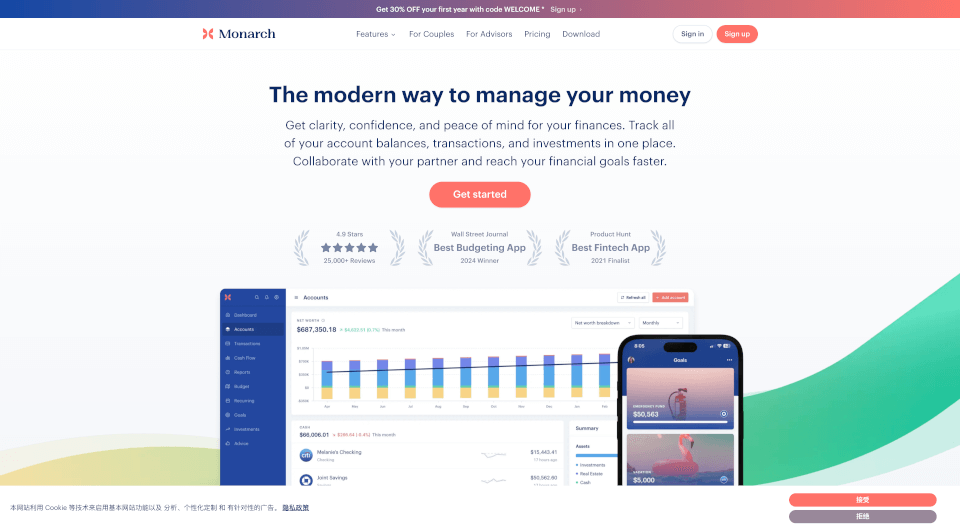

What is Monarch Money?

Monarch Money is a cutting-edge financial management platform designed to help users gain clarity, confidence, and peace of mind in managing their personal finances. With its comprehensive suite of features, Monarch allows individuals and families to track all of their financial accounts, optimize spending, analyze investments, and create actionable financial plans to achieve their goals. Whether you're a couple looking to collaborate or a financial advisor needing a robust tool for your clients, Monarch Money is the modern solution for all your financial management needs.

What are the features of Monarch Money?

Comprehensive Account Tracking

Monarch Money simplifies your financial life by providing a single view of all your account balances, transactions, and investments. Users can easily sync multiple accounts from various financial data aggregators, ensuring they have a complete picture of their finances in one place.

Intelligent Transaction Management

With the power of AI, Monarch automatically cleans and organizes your transactions, making it easier for you to manage your finances. Users have the ability to set custom transaction rules that help auto-update merchant names, categories, tags, and notes to keep everything organized over time.

Flexible Budgeting Tools

Create personalized budgets that cater to your needs using custom categories and rollover features. Monarch empowers users to monitor spending at both the individual category level and aggregate group level, helping everyone stay on track with automatic notifications.

Visual Spending Insights

Gain a better understanding of your spending habits through in-depth diagrams and charts that illustrate where your money is going. This feature allows users to visualize spending patterns and make informed decisions based on data.

Collaborative Features

Invite a partner or financial advisor to securely collaborate on financial management. Monarch provides a shared view of your financial situation without extra costs, allowing couples and families to work together more effectively on their financial goals.

Investment Tracking

With Monarch, users can view and analyze all of their investments in one place. Real-time syncing of investment holdings gives users a clear understanding of portfolio performance and historical data.

Goal Tracking and Planning

Monarch lets users track their financial goals and create actionable plans to achieve them. The intuitive interface alerts users if they veer off their plan, providing guidance to get back on track when necessary.

Customizable Dashboard and Reporting

Personalize your dashboard to match your preferences, enabling easy navigation and identification of financial trends. Build customized reports to dive deeper into your spending and investment analysis.

Top-Notch Security

Monarch takes user security seriously by providing bank-level security for all financial data. User login details are never stored, ensuring that access to financial accounts is strictly read-only, significantly enhancing user security.

Ad-Free Experience

Users of Monarch enjoy a clean, focused experience without unwanted ads. This commitment to an uncluttered interface means users can concentrate on improving their financial life without distractions.

What are the characteristics of Monarch Money?

Monarch Money is characterized by its modern and intuitive design, emphasizing ease of use and a smooth user experience. The emphasis on collaboration, intelligent management features, and visual insights makes it suitable for both individual users and couples. Additionally, Monarch offers no ads, enhancing user focus on their financial goals.

What are the use cases of Monarch Money?

Monarch Money can be applied in a variety of personal finance contexts, including:

- Individual Budgeting: Ideal for solo users looking to track income, expenses, and savings.

- Couple Financial Management: Perfect for partners wanting to collaborate on budgeting, goal setting, and investment tracking.

- Financial Advising: A useful tool for financial advisors seeking to provide comprehensive financial oversight for their clients.

- Investment Tracking: Great for individuals looking to have a consolidated view of their investment portfolios.

- Goal-Oriented Planning: Beneficial for users with specific financial goals such as saving for a house, retirement, or a vacation.

How to use Monarch Money?

To get started with Monarch Money, users need to:

- Sign Up: Create an account on the Monarch Money website or app.

- Connect Accounts: Sync all relevant financial accounts to have a unified view.

- Set Budgets: Create and customize budgets according to personal spending habits.

- Track Spending: Regularly review spending insights via graphs and charts.

- Adjust Plans: Make real-time adjustments to budgets and financial goals based on performance data.