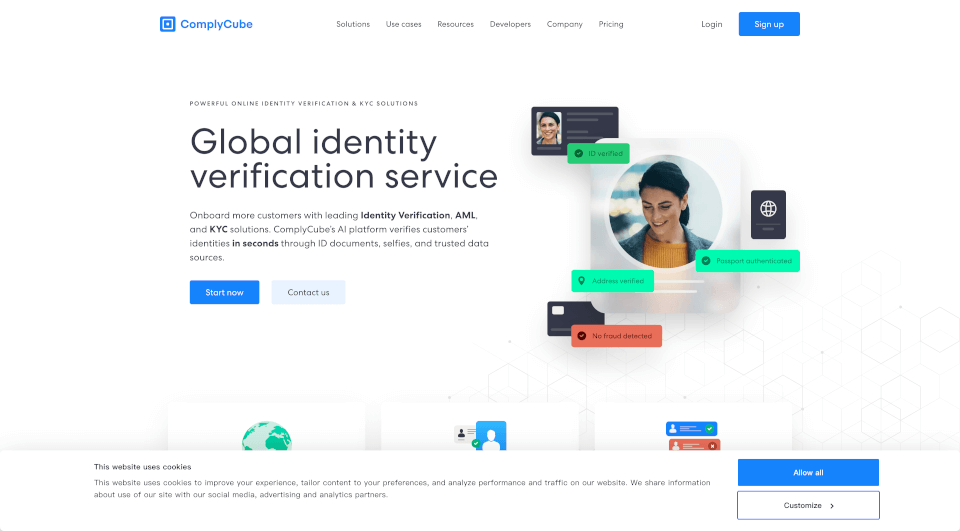

What is ComplyCube?

ComplyCube is a leading SaaS platform that specializes in online Identity Verification, AML (Anti-Money Laundering), and KYC (Know Your Customer) solutions. Designed to enhance security while streamlining the customer onboarding process, ComplyCube enables businesses to verify customer identities in seconds through advanced technology. With a commitment to efficiency and effectiveness, ComplyCube serves a wide array of industries across the globe, ensuring compliance with regulatory standards and safeguarding against fraud.

What are the features of ComplyCube?

- Seamless Identity Verification: Leverage advanced algorithms to verify government-issued documents, including passports, ID cards, and driver’s licenses in less than 30 seconds.

- Biometric Verification: Ensure document ownership and authenticity through biometric checks that utilize facial recognition technology.

- AML Screening: Conduct comprehensive screening for sanctions, PEPs (Politically Exposed Persons), and adverse media checks to mitigate risk associated with money laundering and terrorism financing.

- Address Verification: Validate customer addresses seamlessly, enhancing the quality of data collected within onboarding processes.

- Continuous Monitoring: Get real-time updates and alerts on potential risks associated with customer profiles to proactively handle compliance.

- Multi-Bureau Checks: Corroborate customer data with a wide range of trusted sources, allowing you to build a complete customer profile.

- User-Friendly SDKs: Simplify integration with customizable software development kits (SDKs) designed to enhance user experience without compromising security.

What are the characteristics of ComplyCube?

- Global Coverage: ComplyCube offers services in over 220 countries and territories, ensuring that businesses can efficiently verify identities regardless of location.

- Rapid Onboarding: With a 98% client onboarding rate, businesses can significantly reduce the time it takes to onboard new customers.

- Robust Data Sources: Access to over 3,000 data points from trusted international sources ensures high accuracy and reliability in identity verification.

- Scalability: Whether you’re a startup or a multinational corporation, ComplyCube’s flexible solutions can be tailored to meet your specific compliance needs.

- Real-Time Identity Verification: Advanced AI technology allows for instant identity checks, providing immediate results and reducing friction in user journeys.

What are the use cases of ComplyCube?

- Financial Services: Banks and financial institutions can implement ComplyCube for client onboarding and ongoing due diligence to meet stringent regulatory requirements and prevent fraud.

- Cryptocurrency Platforms: Crypto exchanges and wallets can utilize ComplyCube’s services to effortlessly comply with KYC obligations while enhancing user trust and engagement.

- Telecommunications: Telecommunication companies can verify SIM card holders’ identities quickly and reliably, ensuring compliance with national registration regulations.

- E-Commerce: Online retailers can protect against fraudulent transactions by employing identity checks during the checkout process, reducing chargebacks and enhancing security.

- Gaming and Gambling: Online gaming companies can perform age verification and identity checks to ensure compliance with regulations surrounding age-restricted content.

How to use ComplyCube?

- Sign Up: Create an account on the ComplyCube platform to access the services.

- Integration: Use the provided APIs and SDKs to integrate identity verification solutions into your existing systems.

- Customize Workflows: Configure your onboarding processes to include the relevant KYC and AML checks that suit your business model.

- Verify Identities: Start verifying customer identities by uploading necessary documents for real-time assessment.

- Monitor & Update: Continuously monitor customer profiles for any changes that may require re-verification or additional scrutiny.