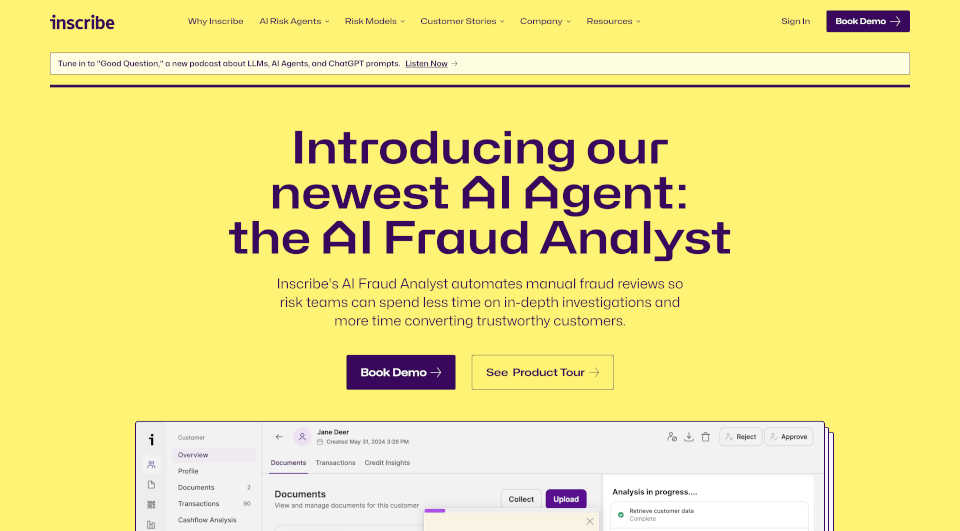

What is Inscribe?

Inscribe is the cutting-edge solution for Fraudulent Document Detection and the implementation of AI Risk Agents. By utilizing advanced machine learning models, Inscribe effectively detects sophisticated document fraud and mitigates various risks during the onboarding and underwriting processes. With a focus on enhancing accuracy and efficiency, Inscribe’s innovative technology allows organizations to streamline operations, reduce costs, and ultimately empower teams to make better, faster decisions.

What are the features of Inscribe?

-

AI Risk Agents: Inscribe features state-of-the-art AI Risk Agents capable of performing onboarding and underwriting tasks with unparalleled efficiency. These agents can seamlessly read, write, and reason, drastically reducing human error and enhancing workflow speed.

-

AI Fraud Analyst: This agent automates manual fraud reviews, enabling risk teams to concentrate on onboarding trustworthy customers rather than getting lost in tedious investigations. This automation significantly increases productivity and allows quicker responses to applications.

-

AI Compliance Analyst: Coming soon, this agent aims to automate due diligence checks and Suspicious Activity Report (SAR) drafts, expediting onboarding processes while ensuring compliance with regulatory standards.

-

Risk Models: Inscribe employs a range of robust machine learning models including Fraud Detection, Document Parsing, Transaction Enrichment, Document Classification, Cashflow Analysis, and Document Verification. These models are designed to provide precise and actionable insights for risk teams.

-

Customer Stories: Companies like Airbase, Bluevine, Plaid, and Ramp utilize Inscribe and have reported significant improvements in detecting fraud and enhancing operational efficiency.

What are the characteristics of Inscribe?

- State-of-the-art Technology: Inscribe's framework leverages the latest advancements in artificial intelligence and machine learning, ensuring the most effective risk management tools in the market.

- 24/7 Operation: AI Risk Agents operate continuously, providing an unlimited capacity to scale operations according to business needs without incurring additional expenses or requiring more personnel.

- User-friendly Interface: Easy to navigate, Inscribe’s platform is designed for teams to quickly adopt and leverage the technology, enhancing user experience.

- Integrated Systems: The AI Risk Agents can effortlessly connect across various systems, ensuring data consistency and reliability to expedite decision-making processes.

What are the use cases of Inscribe?

Inscribe is adaptable to a variety of industries and scenarios, including:

- Fintech Companies: Companies in the financial technology sector can leverage Inscribe to minimize onboarding delays and fraud risks, gaining a competitive edge in fast-paced markets.

- Banks and Lenders: Financial institutions can utilize Inscribe’s AI Risk Agents to enhance their underwriting processes, making it faster and more reliable.

- E-commerce Platforms: With growing fraud concerns, e-commerce businesses can implement Inscribe for better transaction verification and fraud detection.

- Insurance Providers: Insurance companies can benefit from Inscribe by automating underwriting processes, reducing the time taken for policy approval.

- High-Risk Industries: Businesses operating in high-risk sectors can utilize Inscribe’s comprehensive risk analysis to make informed decisions and prevent potential losses.

How to use Inscribe?

To start using Inscribe, follow these simple steps:

- Request a Demo: Interested parties can book a demo to explore Inscribe’s functionalities and see the potential benefits for their specific needs.

- Onboarding Process: Once aligned with Inscribe's solutions, the onboarding process will begin, ensuring all necessary integrations are in place.

- Implement AI Risk Agents: Teams can start utilizing the AI Risk Agents in their operations, monitoring their performance and adapting workflows as needed.

- Continuous Monitoring: Regularly assess the performance of Inscribe’s models and agents, making adjustments to maximize productivity and risk mitigation strategies.

- Utilize Resources: Access additional resources such as podcasts and blogs to stay updated on best practices in AI and risk management.